Global market mechanisms (Article 6)intermediate

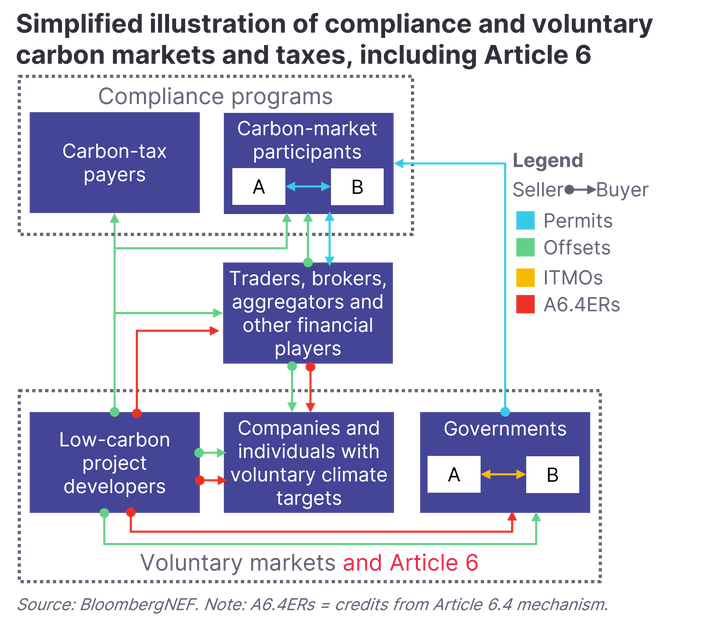

The number of governments and companies pledging increasingly ambitious climate targets – especially net-zero commitments – has risen significantly in recent years. Both countries and companies are now looking at how these objectives can be achieved. Under Article 6 of the Paris Agreement, they will be able to cooperate on achieving their emission-reduction goals through two main market mechanisms. Global carbon trading could save on emission-reduction costs and reinvesting these savings could lower the world’s emissions further.

Key message

The carbon market mechanisms to be implemented under Article 6 of the Paris climate deal will enable governments and companies to collaborate to achieve their climate targets. Article 6.2 entails bilateral deals between countries and Article 6.4 envisages a new global offset market. There is increasing interest in these new systems but some finer details need to be agreed before they can kick off in earnest.

#Breakdown of Article 6

Article 6 of the Paris Agreement includes two key provisions on market mechanisms:

- Article 6.2 involves bilateral deals, whereby country A purchases “internationally transferred mitigation outcomes” (ITMOs) generated by emission-reduction or -removal projects from country B. Country A then uses these carbon credits to achieve its climate targets.

- Article 6.4 envisages the creation of a new global carbon market to be overseen by a Supervisory Body. Developers would need their project to be approved by the host country and then apply to the Supervisory Body to issue approved credits. These could then be sold to governments, companies or individuals. It would be similar to the Clean Development Mechanism (CDM) established under the Kyoto Protocol.

#What has been agreed so far?

Governments reached agreement on the initial rules for these programs at the COP26 climate summit in Glasgow in in 2021, after multiple rounds of failed discussions. One contentious issue was the use of credits generated under the CDM. As a compromise, parties agreed to allow these offsets provided the projects have been registered since January 1, 2013, and meet the same quality criteria as new projects under Article 6.4.

This compromise could increase supply by 173 million metric tons of CDM credits, according to the UN, equivalent to the emissions of the Netherlands in 2018. Such an increase in supply could weaken the incentive for new projects and spark an influx of offsets with dubious environmental integrity. However, these units may only be used for compliance with parties’ first Nationally Determined Contribution plan, meaning the impact on the supply-demand balance should be relatively short term.

As part of the compromise on CDM credits, governments agreed on a strict stance to avoid double counting on Article 6.2 through the use of “corresponding adjustments”. This means that the host country deducts the emission reduction or removal from its inventory when it authorizes the transfer of the carbon credits to the buyer country.

#What does this mean for voluntary carbon markets?

The Article 6 mechanisms could have a significant effect on voluntary carbon markets by helping to scale up and standardize offsets. Efforts by voluntary markets to increase the quality and credibility of offsets could also be leveraged to build the new carbon market. Ultimately, implementation will make or break the market under Article 6.4. If it can be more robust, transparent and efficient than voluntary market registries and standards, we may see a significant surge in both supply and demand for Article 6-compliant projects.

At one extreme, Article 6.4 prevails, merging with the voluntary markets; at the other, the former creates so many administrative barriers and oversupply that only voluntary markets continue. An intermediary outcome would arise where voluntary markets could specialize to accommodate projects that do not fit within the market created by Article 6.4. These could be less robust projects that do not meet the strict criteria, or those looking for returns that may be outside of the standardized price – assuming Article 6.4 results in this.

#How does this differ from the CDM?

Article 6.4 is often referred to as “similar to the CDM mechanism”. Both programs aim to create a market mechanism where emissions are reduced in a cost-effective way. In addition, they have voluntary participation and are subject to international oversight.

However, a crucial difference is that Article 6.4 is expected to deliver an overall mitigation in global emissions (OMGE) – in other words, result in an actual reduction in emissions. This is achieved by canceling offsets once they are transferred to a buyer and used for compliance in order to prevent the selling party from also using it for compliance. This is important in the context that all governments that participate in Article 6.4 will have mitigation pledges – unlike under the CDM, when only buying countries were subject to commitments.

#Outstanding issues

While countries agreed on the initial rules for Article 6 in Glasgow, they have yet to agree on the detailed rules, processes and systems that will enable these programs to get going in earnest.

For example, parties agreed that both Article 6.2 and 6.4 would only issue credits for projects that achieve emission “reductions and removals”. This came after some governments argued that the mechanisms should not allow projects that could lead to future emissions being avoided. However, the precise line between emissions avoidance and reduction is not clear and could lead to further discussions at the COP27 summit in Sharm el-Sheikh. This is a key difference between Article 6 and the voluntary carbon market where, in general, offsets from emissions-avoidance projects are traded, except in certain registries and standards. Governments may want to discuss whether to align other rules on additionality, for example, for the voluntary markets with Article 6.

On Article 6.2, governments have determined a framework for parties to design their own systems for trading ITMOs, establish who can participate, and set out how transactions would be reported, recorded and tracked. The detailed rules and guidelines will be discussed at COP27, as will how to undertake the corresponding adjustments. Some countries, especially non-Annex I parties, may need technical and potentially financial support to set up the governance arrangements and prove that systems for measurement, reporting and verification have been introduced.

Similarly, for Article 6.4, the overarching framework may have been agreed, but the detailed systems and rules have yet to be determined – for example, the process for authorizing projects, central accounting system, and Article 6 database. In addition, further discussions are likely to address the conditions that determine when CDM credits are eligible under Article 6.

Stay up to date

Sign up to be alerted when the web platform goes live.