Voluntary offset supplyintermediate

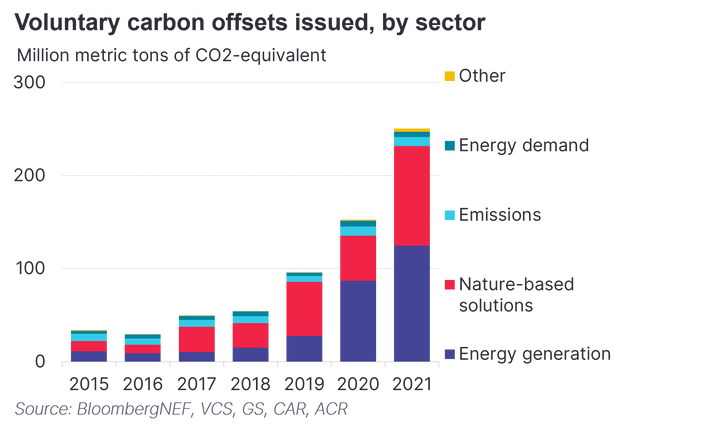

Environmental, social and governance considerations are becoming increasingly important to investors, spurring companies to ratchet up their sustainability commitments and look to carbon offsets to compensate for their emissions. Yet, despite this growth, the voluntary carbon offset market remains oversupplied, with players having access to thousands of potential projects. In 2021, some 344 million offsets had been issued (each representing 1 million metric ton of carbon dioxide equivalent), which is three-and-a-half times more than in 2017. However, issuing projects remain a modest, albeit increasing, share of the total registered.

Key message

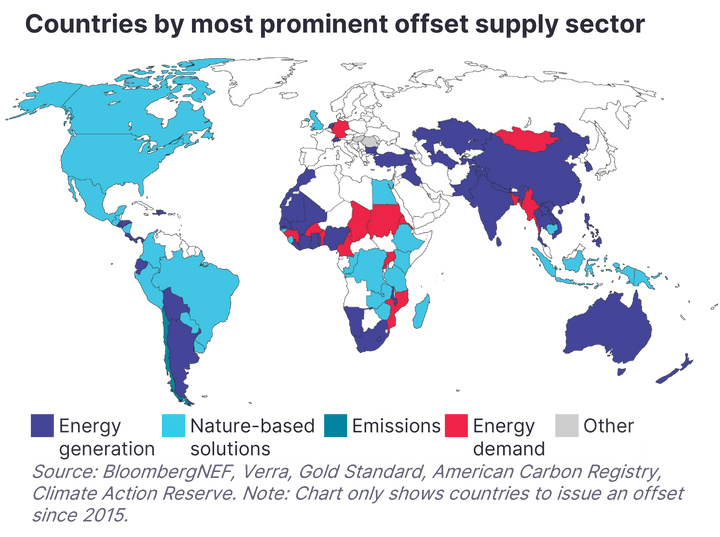

The voluntary carbon markets are oversupplied, with offset issuance climbing 54% on a compound annual basis since 2018. Most have come from nature-based solutions, such as the planting of forests, or energy generation projects, like wind and solar farms. In terms of geography, the US was an early starter, but India, China and Brazil now account for a growing share of offset supply. These trends are set to change due to increasingly stringent regulation on the environmental integrity of offsets.

#Sector

The annual issuance of offsets is accelerating, having set a new record every year since 2016. Part of this momentum is being driven by new projects, but a significant amount of the growth is also coming from existing projects ramping up to meet newfound customer demand. Of the 1,900 projects on the four major registries that issued offsets across 2015-20 (Verra, Gold Standard, American Carbon Registry and Climate Action Reserve), over half issued more offsets in 2021 than in the preceding year. This suggests that a lot of dormant projects exist on voluntary registries that haven’t been actively generating offsets due to a lack of demand. With thousands of projects sitting dormant or issuing far less than their capabilities, this means there is room for substantially more growth in offset supply.

Carbon offsets can be produced by a number of sectors, each with their own strengths and drawbacks. The vast majority of supply has come from energy generation and nature-based solutions. Energy generation offsets are principally from renewables projects, but their role in the voluntary carbon market is set to diminish significantly in the longer term. A key reason is that wind and solar are cost-competitive with new coal and gas-fired power in most parts of the world, without subsidies.

In addition, many of these projects already have support mechanisms in place, such as renewable energy certificates in the US and guarantees of origin in Europe, meaning they cannot produce offsets without double counting. Additionality is therefore hard to prove and, as a result, some registries will now only allow offsets to be generated from clean energy projects in least developed countries.

Nature-based solutions account for a similar share of total offset supply and typically entail reforestation and avoided deforestation projects. The conservation and management of forests around the world is of growing importance. As populations grow, the need for farming, cattle ranching, logging and space for living is magnified, putting forests at further risk of being cut down for these activities. This is concerning from a climate standpoint, as forests are one of the planet’s most effective natural carbon sinks, using photosynthesis to transform carbon into biomass, such as soil. When cut down, forests release the carbon they were sequestering and lose their ability to further store carbon. Offsets can be an effective tool to help finance the protection and management of forests, a practice commonly referred to as “REDD+”.

The planting of new trees, either in areas where forest used to exist (reforestation) or in completely new areas (afforestation), is the other key nature-based solution that will help spur the carbon offset market. Broadly classified as reforestation for simplicity in this report, new forests can offer all of the same benefits that REDD+ projects bring, such as the preservation of biodiversity and mitigation of climate risk. However, what separates reforestation projects from REDD+ is that they lead to new, additional carbon sequestration, or ‘removal’.

Emissions is the third-largest sector of offset supply, focusing on the capture and destruction of greenhouse gases from carbon-intensive operations. Revenue from offsets created via emissions projects is typically used to fund the implementation of capture technologies at fossil-fuel extraction sites, manufacturing facilities or landfills.

In fourth place are energy demand projects. While this can mean energy efficiency upgrades in buildings, energy demand mostly pertains to clean cookstoves. In many developing markets – specifically in Africa and Asia, where just 17% and 60% of the population have access to clean cooking, respectively – people rely on carbon-intensive fuels like dung, kerosene, coal or wood in order to cook. Not only do these fuels lead to significant carbon emissions, but they can also stunt productivity in developing markets. Switching to cleaner cookstoves is an effective way to boost economic productivity in these markets while also decarbonizing. As a result, monetizing carbon offsets can be an effective tool to finance this transition.

#Geography

Beyond sectors, companies have significant flexibility in which markets they can purchase carbon offsets. Projects are registered to issue carbon offsets in over 120 markets around the world. The US saw more carbon offset issuance over 2015-2021 than any other market in the world. But its share of the global total has been shrinking in recent years – to 7% in 2021, down from 54% in 2015. In comparison, India, Brazil and China are on the ascent, accounting for 19%, 13% and 11% of offset supply, respectively, in 2021.

The biggest markets issuing energy generation offsets are India, China and Turkey, although none of these nations are classified as a least developed country. Activity is heavily concentrated in Asia, where legacy projects created for compliance carbon markets have earmarked some of their offsets for voluntary markets. Many of these offsets come from large hydropower projects and coal-to-gas switching. By contrast, the Americas and Central Africa account for the largest share of offset supply from nature-based solutions, due to the prevalence of rainforests.

The US is home to most of the emissions projects that have issued offsets. Many are focused on landfill-gas concerns or methane recovery from coal mines. North America is a world leader in carbon capture and storage, largely due to the presence of natural-gas processing plants, which have cheap carbon capture and tend to be located close to demand sites. Other drivers have been the availability of geological storage, backing and expertise from the mature oil and gas sector, and government support. In the future, more offsets are expected to come from direct air capture, which uses mechanisms like fans and pumps to draw in air and pass it through chemical solutions or solid filters to remove CO2. This CO2 can then be recovered from the collection system and stored.

Supply of energy demand offsets is led by Uganda, Bangladesh and Rwanda. Asia and Sub-Saharan Africa account for the vast majority of the global population without access to clean cooking. Carbon offsets are used as a mechanism to finance the distribution of these stoves and will play a big role in future offset supply.

Stay up to date

Sign up to be alerted when the web platform goes live.