Voluntary offset demandintermediate

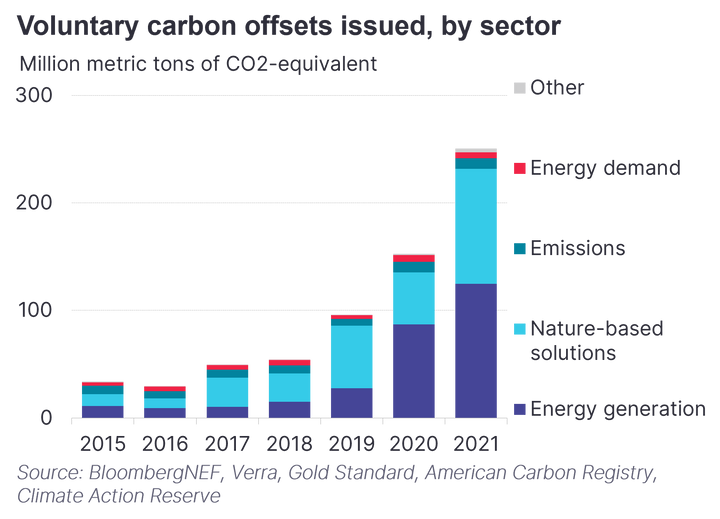

Demand for offsets on the voluntary carbon market is on the rise, with some companies spending tens of millions of dollars to work toward sustainability goals or gain a competitive advantage with customers. Purchasing carbon offsets can serve as an expedient alternative to reducing their own emissions, as it allows companies to make progress on their targets without shifting their business models or risking investments in non-viable technologies. As a result, companies retired some 162 million voluntary offsets in 2021 (each equal to 1 million metric tons of carbon dioxide-equivalent) – almost four times the total in 2015.

Key message

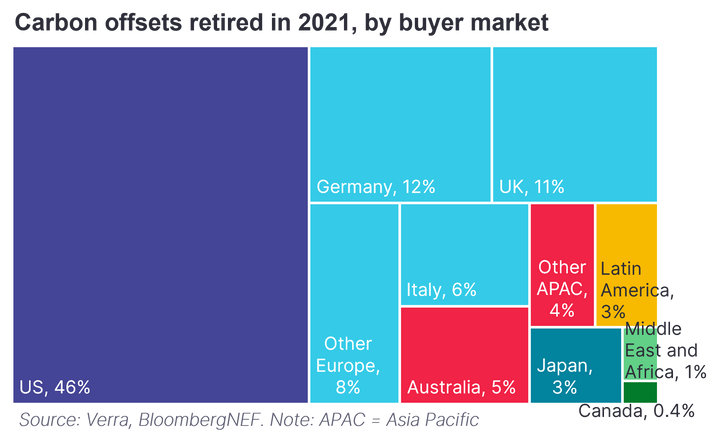

Most of the top corporate offset buyers are consumer-facing, demonstrating the influence of customers, and based in North America and Europe. Buyers primarily opt for offsets from avoided deforestation and energy generation projects – both types of emission-avoidance projects. Many companies are therefore not ready for more regulation requiring the use of offsets from emission-removal projects such as reforestation and direct air capture.

#Overview

A small number of corporations account for a significant share of offsets retired on a voluntary registry. While the top buyers tend to be heavy emitters, they operate in a diverse range of sectors and vary in the types of offset they purchase.

Offset demand is classified as either behavioral or fundamental. Behavioral demand comes from companies buying offsets to satisfy a specific customer, achieving carbon neutrality in particular years or distinguishing a product they offer – for example, “carbon-neutral liquefied natural gas”. Fundamental demand pertains to companies using offsets as a last-resort mechanism to achieve a net-zero emissions goal.

While offset demand is likely to become more fundamentally driven, today, the majority is classified as behavioral. Nearly two-thirds of offsets retired in 2021 came from business-to-consumer (B2C) companies, compared with just 36% for business-to-business (B2B). These companies are customer-facing and many offer programs allowing customers to offset purchases or actions directly through the company.

Several B2C sectors are well known for their customer offsetting programs. The most notable is the transportation and logistics sector, primarily airlines. Over 30 airlines that are members of the International Air Transport Association have offsetting programs, allowing customers to voluntarily pay a premium to make their flights “carbon neutral”.

Internet media and services, telecommunications, software and retail of non-essential (discretionary) goods and services are among the other consumer-facing sectors that purchased significant amounts of offsets in 2021. Top buyers in these sectors are all consumer-facing and purchase offsets to gain a competitive advantage and attract environmentally conscious customers. Other sectors that could soon get more involved in offset buying for behavioral purposes are materials companies (to produce sustainable products like green steel and aluminum), shipping firms and e-commerce providers.

In addition to sectors such as airlines, oil and gas, and automakers, cryptocurrency companies also made up a large portion of carbon offset demand in 2021. Some are using offsets to decarbonize cryptocurrency and blockchain, while others are using these technologies to improve the offset market. Their impact could be reduced in the future: Verra said in May 2022 that it would ban retired carbon offsets from being tokenized by cryptocurrency companies.

It is worth noting that there is a lack of data on voluntary offset demand: companies rarely report their offset transactions, unlike other key sustainability indicators like targets and sustainable debt issuance. One reason is questions about the environmental integrity of some offsets . The data that is available has typically been reported by market participants, leading to inconsistencies and omissions. This factsheet is based on publicly disclosed data from Verra, the largest of the carbon offset registries, accounting for 80% of supply.

#Geography and sector

The lion’s share of voluntary offsets are purchased by companies in developed markets, especially North America and Europe. By contrast, most offsets are created in emerging economies in Asia Pacific, Latin America and Africa. This could help fund developing countries’ decarbonization efforts and enable companies in developed nations (and their governments) meet their climate targets. However, many emerging economies now have their own sustainability goals, raising the potential for emission reductions to be double-counted – by both the country where the offset is created and the country where it is retired. This has led to the concept of corresponding adjustments.

An offset’s sector is its biggest differentiating trait and ultimately influences other factors like its operational cost, where the underlying project can be built and how permanent the emissions reduction is. Avoided deforestation, often abbreviated as REDD+, was the most popular sector with customers in 2021. Despite being classified as avoidance, avoided deforestation projects often have co-benefits outside of decarbonization. They can also create offsets immediately – a reason they are sometimes valued over other nature-based solutions like reforestation, which can sometimes take decades to begin sequestering carbon. While they may be criticized by investors for taking advantage of forests not at risk, for many projects, offsets represent important investments to protect trees.

Energy generation was the second-most popular offset sector with companies in 2021. However, it is gradually losing its appeal as registries like Verra limit when offsets can be created from energy generation projects because these are often already economically competitive with dirtier alternatives. Projects in least developed countries may still be allowed under certain circumstances. In addition, renewable energy certificate schemes, which work like an offset but cover electricity rather than emissions, are becoming more popular. Clean-energy developers may opt to sell these certificates instead of carbon offsets, as they cannot do both due to double-counting.

#Other trends

Co-benefits, or the additional positive attributes a carbon offset brings outside of decarbonization, are growing more popular over time, and can range from wildlife protection to benefits for indigenous communities. Projects that have co-benefits tend to be valued higher and can sell their offsets for a premium. They are also in higher demand. In many cases, the offsets are “benefic-agnostic”, meaning the project was generally listed as meeting all of the UN Sustainable Development Goals or having achieved Verra’s Climate, Community and Biodiversity verification. Benefit-agnostic offsets were the most popular type of co-benefit among companies in 2021.

The second-most popular type of co-benefit came from projects specifically earmarked for having social benefits, such as improving the livelihood of local communities or developing a water treatment facility. In third place was biodiversity and climate co-benefits ¬– for example, protecting local wildlife populations.

Demand for carbon offsets today is elastic and many companies prioritize purchasing the cheapest offsets regardless of quality – perhaps the biggest criticism of the market today. Should prices for offsets rise, companies will respond differently. Many of the largest offset buyers are currently consumer-facing companies, meaning that the customer bears some of the costs. Should offset prices rise too far, many companies will lose any competitive advantage they have by offering offsets because customers will not be willing to pay such a premium. This could have the adverse effect of pricing these companies out of the market, or forcing them to buy cheap, low-quality offsets at a greater rate. Companies driven more by sustainability goals may prioritize gross emission reductions further, relying less on offsets.

Stay up to date

Sign up to be alerted when the web platform goes live.