Voluntary offset standardsintermediate

Voluntary carbon offsets can have widely different prices, even for projects in the same sector and location (see the factsheet on quality. However, there is no objective way to determine the quality of a voluntary carbon offset and pricing is somewhat of a black box. This often means buyers have to work with a third party, which can further complicate and lengthen the purchasing process. For these reasons, voluntary carbon offsets are prohibited under some sustainability initiatives, although efforts to better differentiate quality in the offset market are well underway.

Key message

A raft of initiatives are underway to improve the environmental rigor of voluntary carbon markets, such as the Science Based Targets initiative and the Integrity Council on Voluntary Carbon Markets. Alongside these initiatives, there is also a lot of work being done by private-sector players, who are developing technologies to improve measurability.

#Science Based Targets initiative

The Science Based Targets initiative (SBTi) is the largest third-party initiative verifying companies’ emissions-reduction commitments. To date, over 3,000 companies have set, or agreed to set, a science-based emissions target, meaning they pledge to cut their greenhouse-gas output in line with the aims of the Paris Agreement. Their goals must meet a range of criteria that aim to ensure credibility – for example, the targets must cover at least 95% of company-wide Scope 1 and 2 emissions – and carbon offsets may not be used.

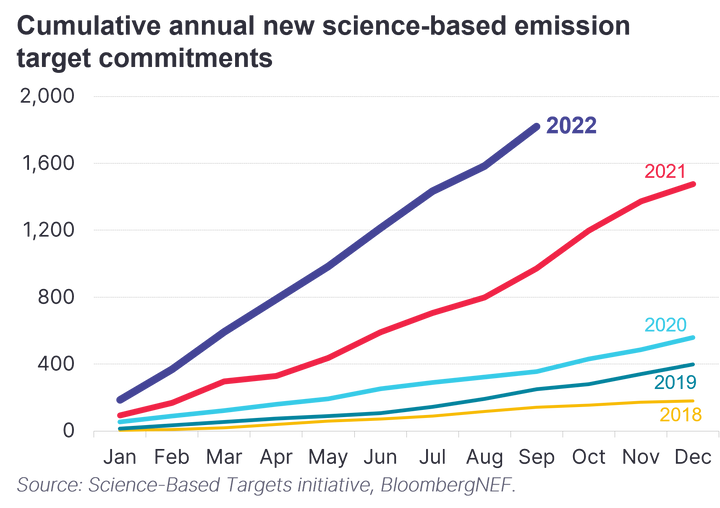

Nearly 1,600 companies set, or committed to set, a science-based target in the first eight months of 2022, compared with 1,475 in the whole of 2021. Over 1,300 have pledged to set a net-zero target with the SBTi.

However, the SBTi published its net-zero framework in 2021, allowing companies to take their science-based targets a step further and pledge to fully reduce and/or offset their emissions by 2050. In order to do this, firms should be reducing their gross emissions by 50% by 2030 and at least 90% by 2050. The SBTi determines this to be a Paris-aligned trajectory, with slight variations depending on sector. Contrasting the regular science-based targets, companies may use offsets for their net-zero targets for any remaining, or ‘residual’, emissions. This is subject to the condition that in the deadline year, any offsets used must come from projects that remove greenhouse-gas emissions, rather than avoidance projects.

This restriction is likely to increase demand for removal offsets, especially closer to mid-century. Removals currently make up a small part of the offset market (less than 10% of issuance in 2021) and future supply will be determined by technologies like direct air carbon capture, which are still nascent and expensive. A carbon offset market operating under the SBTi’s methodology would see significant increases in prices, due to the huge swathe of supply no longer permitted. This may force companies to invest more in reducing their own gross emissions, eliminating the need to offset as much as they can.

#Taskforce on Scaling Voluntary Carbon Markets

Announced in September 2020, the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) was created by the International Institute of Finance in partnership with a committee of public and private taskforce members. The group aimed to serve as a steward for the carbon offset market, primarily through the following mandates:

- Create a set of core carbon principles, outlining key traits required by a high-quality carbon offset in order to be bought or sold on the market

- Outline eligibility principles for various suppliers and developers interested in entering the market

- Develop a core governance body to enforce core carbon principles and uphold integrity in the market

- Create benchmark contracts and promote the development of trading infrastructure like exchanges and forward curves to improve liquidity in the market.

Several groups have spawned out of TSVCM to tackle the above areas. The Integrity Council for the Voluntary Carbon Market has been launched by the Taskforce to focus on tackling quality and integrity concerns on the supply-side of the market. First on its agenda is to devise new threshold standards for high-quality offsets (the core carbon principles). The Voluntary Carbon Markets Integrity Initiative (VCMI) was launched to help determine when and how companies should buy offsets on the demand-side of the market.

The work of these initiatives has been met with criticism. Some stakeholders have concerns that some of the mandates recommended above, such as the creation of benchmark contracts and the promotion of exchanges, will make all carbon offsets the same and actually forfeit quality, rather than give it a boost. There are ongoing concerns that the governance body does include enough perspectives and could compromise the role of individual registries moving forward.

#Technology-based initiatives

Beyond initiatives focused on market design, dozens of companies are raising money for technologies aimed at improving the reputation of the offset market. Many, including Pachama, Cloverly and Cooler.dev, are focused on enhancing measurability, creating their own unique technology cocktails of lidar, satellite imagery, drones and atmospheric data to better estimate and measure offset supply, specifically from forestry and agriculture projects.

Some of these firms are more focused on verification and bifurcation of quality. Beyond helping to measure emission reductions, Pachama, for example, is building its own marketplace for projects that have been verified with its technology, giving customers a boost in confidence that they are investing in high-quality projects. There are also companies like Sylvera that are scoring projects on their overall quality to help buyers easily identify which projects they should purchase offsets from.

Stay up to date

Sign up to be alerted when the web platform goes live.